03 Jun Queen’s spin-out Re-Vana Therapeutics raises €2.9m in funding

Clarendon portfolio company Re-Vana Therapeutics the Queen’s University spin-out has secured $3.25 million (€2.9 million) in funding.

Among the backers are three specialised US ophthalmic venture capital funds: ExSight, Visionary and InFocus.

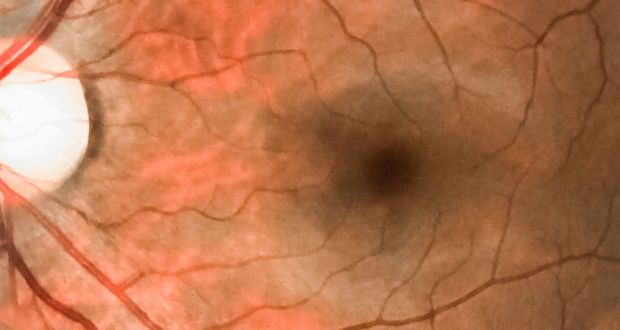

Re-Vana is a drug delivery company focused on the treatment of chronic eye diseases such as age-related macular degeneration and Glaucoma.

The seed round was oversubscribed by more than $1 million and closed in two tranches. The first $2.08 tranch was led by ExSight Ventures with participation from InFocus Capital and several existing backers, including Qubis. The second closing round was led by Visionary Ventures.

Representatives from some of the backers are also to join the company’s board.

Re-Vana said the investment will primarily be used to advance its proprietary biodegradable technologies for the delivery of therapeutics.

Focused investors

“Financing from new and existing investors during this challenging time is a testament to the potential of Re-Vana’s technologies for sustained delivery of both biologic and small molecule therapeutics,” said Michael O’Rourke, the company’s president and chief executive.

“We are especially fortunate to have three highly respected, US ophthalmic-focused investors join our board . . . as we initiate preclinical development and expand our strategic partnerships,” he added.

Re-Vana last year also secured funding from Innovate UK totalling more than $400,000 to support the development of a sustained release drug.